Happy New Year to all!

This is my very first topic that I’d like to discuss. ![]() Warning, it’s rather long and heavy.

Warning, it’s rather long and heavy.

I wanted to start 2025 by asking this important question to the Chameleon community - Does CHML Network need a fair launch to survive?

Before we dive in, I just want to say that this post does not take into consideration the existing blockchain technology that was developed by the incognito team. I am not a developer. I am also not approaching this from a speed or TPS pov.

I am a privacy advocate and I am involved in many other privacy projects. I think Privacy is essential for freedom. Without it we become slaves. Big Gov, Big Tech & Big Banks will all want this project to fail. This post is about how do we ensure CHML Network has the best chance of survival against these adversaries.

I think there’s no point rebooting Incognito if there is not going to be a fair distribution of tokens from the “Genesis” block.

The reasons I say this is the regulation are much clearer around Bitcoin because:

a) it had a Fair Launch - meaning anyone could mine BTC with a PC by downloading some open source software.

b) it was decentralized and grew globally.

c) there was no fund raising via an ICO (this is a big ‘No No’ with the regulars like the SEC.)

d) No centralized Corporation/Organization was involved in the issuance of BTC

e) There was no Pre-mine, hence no central authority had control over the supply.

How will CHML Network be funded?

This is a great questions. But sorry that is a separate topic on it’s own. However, I do understand that having a Pre-mine or having an ICO are great ways to raise money. But, what if those mechanisms lead to the ultimate demise of the CHML project?

An ICO / Pre-mine may raise regulatory scrutiny and cause CHML to be deemed illegally funded and shut down.

Is that worth risking?

This is why I’m raising the question as I think having a Fair Launch is essential to CHML Network’s survival.

Btw, in full disclosure, I’m not a lawyer.

I know some of you might be thinking, “But there will be more regulatory clarity with a ‘presumably’ pro-crypto president taking the Whitehouse soon,” In my personal opinion, I think that would be foolish assumption.

Who’s to say (when the tide turns) and an anti-crypto President takes charge, CHML Network may come under scrutiny and be shutdown. All the hard work and money raised by an ICO / Pre-mine will be in vain.

Here are some ideas around CHML tokenomics and achieving a Fair launch…

No Pre-mine. No ICO.

If we have a pre-mine or ICO, this would mean there was some central authority that had the power and ability to issue CHML tokens. Hence, it would be very easy for regulatory bodies to prove our project did not have a fair launch or a fair distribution of tokens.

For those who follow the Zano project, look at all the drama they have around their “Pre-Mine”. It always comes up in discussions and becomes a major distraction for them. It would be a shame is CHML has the same issues around Pre-mine.

ICOs also make people very nervous about ICO whales dumping on the community and driving the price into the ground essentially destroying the project. There will be many people in gov, tech and banks that will want to see CHML Network fail and they have spies everywhere.

I think we should achieve a fair distribution of CHML Tokens via a special kind of Polyphasic Proof of Work + Proof of Stake consensus mechanism (keep reading…)

Proof of Work

Let’s make CHML Tokens available to anyone via mining on commodity (nothing special) hardware E.g. A PC running open source software that does Proof of Work using it’s CPU, GPU or via ASIC (for those with old Bitcoin mining hardware).

Reference: I like how Epic Cash have implemented Polyphasic PoW (read this article for more details - Epic Cash: Proof Of Work Evolved - Tilman’s Newsletter )

Proof of Stake

Once miners have mined enough CHML Tokens, they can (if they wish) stake CHML Tokens to there Validator nodes (formerly incognito’s pNodes and vNodes). This is where the PoS comes into play.

Hence, CHML Network will be a hybrid consensus model based on a Polyphasic PoW+PoS (which I think might be a first in the entire blockchain industry).

This has been done before with other Privacy blockchains. The Devs would need to understand how FIRO and ZANO have done PoW+PoS consensus,

But remember, CHML Network has the potential to be even more secure than those other chains by implementing a Polyphasic approach (what Epic Cash uses) so that CHML will be the most inclusive network allowing anyone with any kind of PC (not just gamers with spare GPU capacity) to participate in mining of CHML Tokens.

An example of a Polyphasic configuration

For example, here’s an example of the initial “share” allocation of rewards to miners & stakers:

A) 30% - PoW CPU algorithm

B) 30% - PoW GPU algorithm

C) 35% - PoS validators

D) 5% - PoW ASIC algorithm

Let me break this down for you …

Let’s say the given time period is a month (roughly 720 hours).

Over the course of a month CPU miners will have jobs allocate to them 30% of the time (720*30% = 216 hours). If the miner successfully completes the work, that miner wins the block reward.

If you’re running a node (PoS), rewards will be randomly allocated to validators during the 35% time allocation (252 hours) over the course of the month. etc. etc.

The time allocated to each of the 4 cohorts (A,B,C,D) is just an average. But here’s where the polyphasic approach makes this blockchain so awesomely secure… The cohort is randomly selected, meaning, just because my CPU miner has accepted a job this instant, this does not mean my mine will gets to work on the next job. The polyphasic algorithm may decide to push the next job to the “ASIC” miner cohort. A hacker will not know which cohort will be randomly selected next in order to carry out a successful attack.

I hope people can appreciate the genius and added security of the Polyphasic PoW+PoS mechanism.

The CHML DAO can vote of reward allocation % and algo changes

The above is just an example, but the allocation percentages can be voted upon by the community and changed as time goes on. For example, once the community feels the PoW mining is no longer needed, the percentages can be shifted more to PoS validators, thus validators will receive a greater share of the rewards over time.

We can also make the algorithms interchangeable, For example we can put it to a community vote as to whether we swap out the CPU Randomx algorithm for a “Quantum Computing” resistant algorithm.

This will help future proof CHML Network and make it one of the most innovative and secure blockchains on the planet.

No Halving Cycle madness

I’m of the opinion that halving cycles only add unnecessary complexity and cause for market speculation. Instead I really much prefer what the WOWNERO Dev team have implemented in terms of their emission shedule.

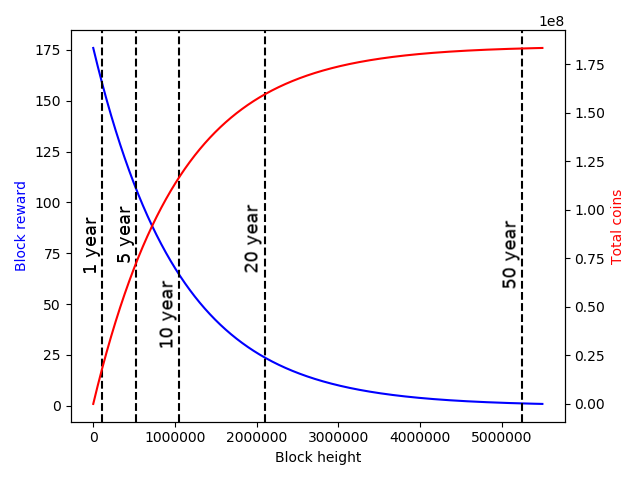

You can see their emission curve here:

It’s essentially the same exponential decay as Monero, but stretched out over 50 years or so rather than 7 or 8 years for Monero. Also note it has a fixed supply and there is no tail emission.

It is all calculated from the source code.

Here is the function: wownero/src/cryptonote_basic/cryptonote_basic_impl.cpp at 4c6c7ab87b2a56165f400f6e49f17b9577a2bcad · wownero/wownero · GitHub

and you can get the params to plug into the function in here: wownero/src/cryptonote_config.h at master · wownero/wownero · GitHub

Fixed Supply

I like having a fixed supply as that narrative seems to have helped create scarcity and value for Bitcoin. Given that the masses are starting to wake up to the fact that money printing is detrimental to their store of value, they will want to avoid projects with inflationary coin supply.

Thanks for reaching the end of this post.

I hope it is the catalyst for some good discussion in this community. I think we are part of something very special here and we need to make ensure this project has the best chance of surviving regulatory scrutiny as the freedom and financial privacy of generations to come will need CHML Network.